Taxation is a vital view of any thriftiness, serving as the primary source of revenue for governments world-wide. It is a complex area that requires a deep sympathy of laws, regulations, and business principles. For those looking to establish a career in this domain, technical training and grooming are necessity. This clause delves into the various educational pathways available, including the Diploma in Taxation, Diploma in Taxation Law, Taxation Courses, and Tax Consultant Courses. These programs are studied to fit students with the cognition and skills necessary to navigate the complex earth of taxation.

1. Diploma in Taxation

A Diploma in Taxation is a technical programme that focuses on the principles and practices of revenue. It is ideal for individuals who wish to gain a foundational understanding of tax systems, tax preparation, and compliance. This diploma is often chased by Recent epoch graduates, working professionals, or those looking to swop careers into the orbit of revenue.

Key Features of a Diploma in Taxation:

-

Duration: Typically ranges from 6 months to 1 year, depending on the insane asylum and mode of meditate(full-time or part-time).

-

Curriculum: Covers topics such as income tax, organized tax, indirect taxes(like GST or VAT), tax planning, and tax submission.

-

Eligibility: Most institutions require a high school sheepskin or equivalent weight. Some programs may also need a downpla in commerce, finance, or law.

-

Career Opportunities: Graduates can work as tax assistants, tax analysts, or tax consultants in method of accounting firms, corporate finance departments, or politics agencies.

Benefits of Pursuing a Diploma in Taxation:

-

Practical Knowledge: The programme provides work force-on grooming in tax preparation, filing, and submission.

-

Industry-Relevant Skills: Students learn to understand tax laws and apply them in real-world scenarios.

-

Career Advancement: The sheepskin serves as a stepping pit for higher qualifications, such as a degree in taxation or professional certifications like CPA(Certified Public Accountant) or ACCA(Association of Chartered Certified Accountants).

2. Diploma in Taxation Law

A Diploma in Taxation Law is a more specialized program that focuses on the effectual aspects of tax income. It is designed for individuals who wish to sympathize the legal model government activity tax systems, including tax disputes, litigation, and insurance policy-making. This sheepskin is particularly healthful for law graduates, effectual professionals, and tax consultants.

Key Features of a Diploma in Taxation Law:

-

Duration: Usually spans 1 year, though some institutions volunteer shorter or yearner programs.

-

Curriculum: Includes subjects such as tax legislation, international tax income, tax judicial proceeding, and tax policy.

-

Eligibility: A bachelor’s degree in law(LLB) or a related arena is often needful.

-

Career Opportunities: Graduates can work as tax attorneys, effectual advisors, or insurance analysts in law firms, incorporated sound departments, or political science bodies.

Benefits of Pursuing a Diploma in Taxation Law:

-

In-Depth Legal Knowledge: The program provides a thorough understanding of tax laws and their implications.

-

Specialization: It allows effectual professionals to specify in tax revenue, a recess and high-demand area.

-

Enhanced Career Prospects: The sheepskin opens doors to roles in tax judicial proceeding, consultatory, and insurance policy-making.

3. Taxation Courses

Taxation Courses are short-term programs that focalise on particular aspects of tax revenue. These courses are nonsuch for individuals who want to update their knowledge, gain new skills, or specialize in a particular area of taxation. They are often offered by universities, professional bodies, and online platforms.

Types of Taxation Courses:

-

Basic Taxation Courses: Cover fundamental concepts such as income tax, deductions, and filing procedures.

-

Advanced Taxation Courses: Focus on topics like International revenue, transfer pricing, and tax audits.

-

Specialized Courses: Target specific areas such as GST, VAT, or corporate tax income.

Key Features of Taxation Courses:

-

Duration: Can range from a few weeks to several months, depending on the course content.

-

Mode of Delivery: Available in online, offline, or loan-blend formats.

-

Certification: Most courses volunteer a certificate upon completion, which can raise your resume.

Benefits of Taxation Courses:

-

Flexibility: Short-term courses allow professionals to upskill without committing to long-term programs.

-

Focused Learning: Students can select courses that align with their goals.

-

Networking Opportunities: Many courses cater get at to manufacture experts and peers.

4. Tax Consultant Course

A Tax Consultant Course is a specialized program premeditated to train individuals to become professional person tax consultants. Tax consultants are experts who rede individuals and businesses on tax-related matters, including compliance, preparation, and optimisation.

Key Features of a Tax Consultant Course:

-

Duration: Typically ranges from 6 months to 1 year.

-

Curriculum: Covers tax laws, business planning, scrutinise procedures, and node management.

-

Eligibility: A downpla in finance, method of accounting, or law is often preferred.

-

Certification: Some courses volunteer professional certifications, such as Certified Tax Consultant(CTC) or Enrolled Agent(EA).

Benefits of Pursuing a Tax Consultant Course:

-

Professional Expertise: The course equips students with the skills requisite to ply expert tax advice.

-

High Demand: Tax consultants are in across industries, making it a lucrative career option.

-

Entrepreneurial Opportunities: Graduates can take up their own tax firms or work as independent consultants.

Career Opportunities in Taxation

The arena of tax income offers a wide range of career opportunities for competent professionals. Some of the most commons roles let in:

Tax Analyst: Responsible for analyzing tax data, preparing reports, and ensuring compliance.

Tax Consultant: Provides advice on tax preparation, optimization, and submission.

Tax Attorney: Specializes in tax law and represents clients in tax disputes and judicial proceeding.

Tax Auditor: Conducts audits to see compliance with tax laws and regulations.

Policy Analyst: Works with politics agencies to prepare and put through tax policies.

Choosing the Right Program

When selecting a tax income program, consider the following factors:

-

Career Goals: Choose a programme that aligns with your long-term aspirations.

-

Accreditation: Ensure the program is recognised by at issue professional person bodies.

-

Curriculum: Look for a comprehensive program that covers both theoretic and realistic aspects.

-

Mode of Delivery: Decide whether you favor online, offline, or hybrid learning.

-

Cost and Duration: Consider the program’s affordability and time .

Conclusion

A Diploma in Taxation, Diploma in Taxation Law, Taxation Course, or Tax Consultant Course can open doors to a pleasing in the orbit of taxation. These programs cater the noesis, skills, and certifications necessary to stand out in various roles, from tax analysis to consultancy and valid informatory. Whether you are a Holocene graduate, a working professional, or someone looking to switch careers, investing in a taxation breeding can importantly heighten your prospects. With the incorporative complexity of tax systems intercontinental, the demand for mean revenue professionals is on the rise, making this an ripe time to quest after a career in this domain.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Michael Bower Then & Now!

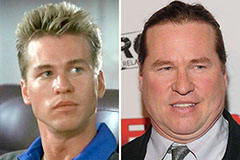

Michael Bower Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!